According to one recent study, workers who make up the "gig economy" contributed roughly 5.7% to the gross domestic product of the United States in 2021 alone. If you needed a single statistic to help underline what a significant shift this has become in the way that we all collectively think about employment, let it be that one.Of course, eschewing the potential challenges of "traditional" employment brings with it new ones in the form of gig-based work. This is

View More

Blog

Best Practices to Help Guarantee Success for Your Gig Enterprise

November 22, 2023Tax Refund Direct Deposited

May 5, 2023Are You Worried You Won't Have Enough Money Saved for Retirement?

March 3, 2023All of us dream of one day being able to retire - to finally be able to relax and enjoy the lifestyle we worked so hard for. However, you'll need a significant amount of money to do it, which is where a lot of Americans begin to worry. Saving for retirement is a constant fear for many out there, especially during periods when the economy is hurting. The good news is that not everyone needs to save the same amount for retirement. By performing a few simple calculations now, you can help

View More

Are You an S Corporation Stockholder? Are You Taking Reasonable Compensation in

March 3, 2023 Article Highlights: S Corporation Compensation Reasonable CompensationFactors Determining ReasonablenessIn the SpotlightSec. 199A Deduction S corporation compensation requirements are often misunderstood and abused by owner-shareholders. An S corporation is a type of business structure in which the business does not pay income tax at the corporate level and instead distributes (passes through) the income, gains, losses, and deductions to the shareholders for inclusion on their inco

View More

Tax Benefits for Grandchildren

March 3, 2023 Article Highlights: Financially Assisting GrandchildrenCollege savingsEducation savingsRetirement accountsMedical expenses If you are a grandparent there are several things you can do to teach your grandchildren financial responsibility and set aside money for their future education and retirement. Before we get into actual suggestions, it is important that you understand the gift tax rules. You can give anyone, every year, an amount up to the annual gift tax exclusion. The

View More

Be On the Outlook for Tax Reporting Forms

March 3, 2023Be On the Outlook for Tax Reporting Forms Article Highlights: Form W-2Form W-2GForm 1099-GForm 1099-MISCForm 1099-DIVForm 1099-INTForm 1099-BForm 1099-SForm SSA-1099Form RRB-1099Form 1099-RForm 1098-TForm 1095-AForm 1099-NECForm 1099-KSchedule K-1 With tax season upon us, documents reporting income, sales and other items needed for your 2022 tax return should have arrived or will be arriving soon. Be on the lookout for them and be careful not to accidently discard any. Here are some of th

View More

Planning On Buying a New Electric Vehicle and Claiming a Tax Credit?

March 3, 2023Planning On Buying a New Electric Vehicle and Claiming a Tax Credit? Better Read This First Article Highlights: BackgroundQualifications Income Limit4-wheel vehicleStreet VehicleMinimum Battery CapacityAcquired for Original UseFinal AssemblyMSRPCritical Mineral and Battery Components Seller Provided ReportList of Qualifying VehiclesTransfer of Credit to the Dealer Although the credit for purchasing a new electric vehicle can still be as much as $7,500, Congress has added some ne

View More

Many Taxpayers Will See Smaller Refunds This Year

March 3, 2023Many Taxpayers Will See Smaller Refunds This Year Article Highlights: Child Tax Credit Dependent Care BenefitsRecovery RebatesEmployee Retention Credit Congress has for years used the tax return as a means of providing benefits to taxpayers in need and incentives to stimulate activities in business, as well as addressing environmental issues. So when COVID-19 hit, Congress and many state governments provided tax benefits to help citizens through the pandemic. Because the COVID pande

View More

Tax Benefits For Parents

March 3, 2023Tax Benefits For Parents Article Highlights: Child Tax CreditEarned Income Tax CreditHead of Household Filing StatusChild CareEducation Savings PlansEducation Tax CreditEducation Loan InterestChild’s Medical Expenses If you are a parent, whether single, married or divorced, there are a significant number of tax benefits available to you, including deductions, credits, and filing status that can help put a dent in your tax liability. Child Tax Credit –You may be entitled

View More

Haven't Filed Tax Returns for Multiple Years?

March 3, 2023Haven't Filed Tax Returns for Multiple Years? Here's What You Need to Do Next You'd be hard-pressed to find someone who actually enjoys the process of filing taxes. Having said that, it's absolutely something that you're supposed to do like clockwork every single year.Of course, there are a myriad of different reasons why you may have fallen behind. You could be going through something of a major life transition and simply were unable to meet the filing deadline. M

View More

If Your Business is a Delaware Corporation, There Are Important

March 3, 2023If Your Business is a Delaware Corporation, There Are Important Upcoming Tax Deadlines to Be Aware Of When starting a business, many entrepreneurs choose to incorporate in Delaware for a wide range of different reasons. Chief among them are the tax-related benefits, like the fact that if you're registered in the state but don't do business there, you don't have to deal with state corporate income tax. Delaware also has a reputation for protecting a business' privacy, allowin

View More

How to Receive Payments in QuickBooks Online

March 3, 2023It’s more enjoyable than paying your bills. Here are three ways to process incoming money from customers.One of the biggest problems small businesses face is maintaining a positive cash flow. It’s a constant battle. How do you keep your income running ahead of your expenses?QuickBooks Online can help. It provides specialized forms and a mobile app that help you record and deposit the payments that are coming in. Do you ever receive payments instantly for some products and/or services

View More

Home Energy Improvement Credit Is Enhanced

March 3, 2023Article Highlights: Credit HistoryCredit Percentage and Annual Credit LimitPer Item Credit Limit Home Energy AuditIdentification Number RequirementOther Credit IssuesTip To Maximize The Credit This credit goes all the way back to 2006, providing a tax credit for making energy-saving improvements to a taxpayer’s home. This tax benefit was supposed to expire after 2021 but a law change has given the credit renewed life and substantially enhanced it beginning with 2023. Prior to 2023

View More

Should You Pay Off Debt or Save for Retirement?

November 28, 2022 Just because you have student loans to pay off doesn't mean you should put investing on hold to do it—you don't have to prioritize one over the other.

View More

What Do I Need to File My Taxes? (Tax Preparation Documents)

November 9, 2022.png)

Tax filers should collect the following documents for a tax preparation appointment: Social Security cards for all family membersDriver license or non-drivers ID (spouses filing jointly must both be present)Last year’s federal and state tax returnsW-2 forms1099s for interest, dividends, retirement, Social Security, unemployment or self-employment1095 for health insurance coverageLetters or documents from the IRSChildcare receipts – name, address, tax ID# and amount paidTuition expens

View More

Support Your Business Goals With Tax Plans and Preperation

November 8, 2022.png)

In today's complex tax environment, proactive tax planning should be part of your company's overall business and financial strategy. As tax reform continues to create sweeping tax changes, let Clarity Capital's business tax consultants advise you on how to reduce and manage your tax obligations. We work closely with you to create a strategic tax plan that can support your business goals and create opportunities for reinvestment that can be used to drive growth, increase profitability

View More

What Is a Trust Fund, and How Does It Work?

November 8, 2022~001.png)

Trust funds were once associated with high net worth individuals as a way to pass money to their heirs or charitable organizations. But trusts are fast becoming a popular tool for everyone, wealthy or not, as a solution in their estate planning. What is a trust fund? Trust funds are legal arrangements that allow individuals to place assets in a special account to benefit another person or entity. Trust funds can be complex and often require the assistance of an attorney to set up, though there

View More

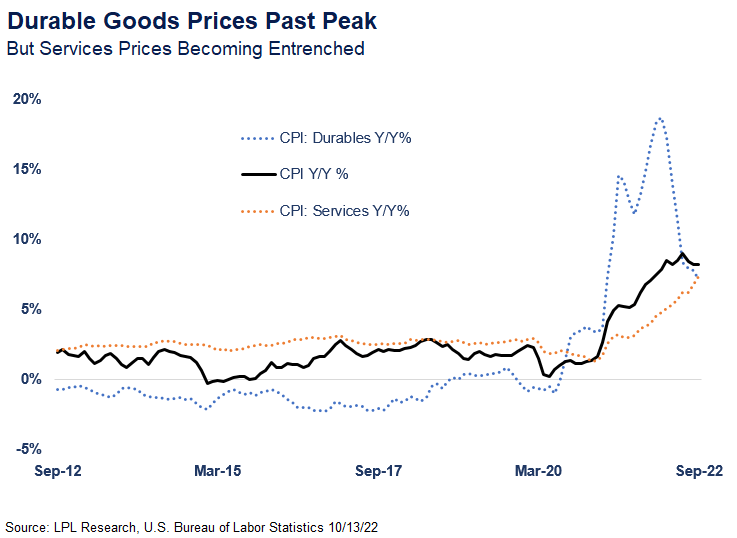

CPI Disappoints (Consumer Price Index): Inflation is Unevenly Distributed

November 7, 2022

The core Consumer Price Index (CPI), which excludes food and energy, rose to a multi-decade high in September, disappointing both investors and policy makers. The CPI is one, but not the only metric for inflation.September headline inflation eased slightly to 8.2% year-over year from 8.3% in August. Energy commodity prices outright declined for the last three months, offsetting the accelerating price increases in other areas such as food and rent. Core inflation, which excludes food and energy,

View More

Should You Switch Up Your Savings Plan Due to New Saving Interest Rates

November 7, 2022

The Federal Reserve has signaled that lower interest rates could be coming in the future, this has some Americans wondering if they should make changes to where their savings accounts are stored.

View More

Worst Day For Stocks Since June 2020 But What Happens Next?

September 30, 2022

Tuesday (September 13th) turned out to be a very bad day for global stocks, as a hotter than expected US inflation report spooked market participants. The CPI report pushed back on some of the peak inflation narratives and all but confirmed that the Federal Reserve (Fed) will hike rates at least 75 basis points at their September Federal Open Market Committee (FOMC) meeting next week (September 20-21).“To say the market reacted badly to the inflation report would be an understatement&rdquo

View More

Lunch Box Stagflation Isn’t Your 70s Style Slowdown

September 30, 2022

It’s hard not to call what we’re experiencing stagflation at this point, if there are any holdouts left. With growth flat for the first half of the year, growth expectations for the rest of the year muted, inflation continuing to run very hot, and the Federal Reserve (Fed) aggressively raising rates, we clearly have the combination of economic weakness with high inflation that gave “stagflation” its name.But this is not your 1970s style stagflation and the ultimate conseq

View More

Fed Gets Pessimistic, Yet Realistic

September 30, 2022

A Bit More Pessimistic, A Lot More RealisticThe Federal Open Market Committee (FOMC) increased the target rate by 75 basis points (bp) to a 3.25% upper bound and delivered a more pessimistic outlook in their published Summary of Economic Projections.The Committee hiked rates at this magnitude for the third consecutive time and Federal Reserve (Fed) Chairman Powell signaled “ongoing increases…will be appropriate.” So at this point, we expect a 50 bp hike at the next meetin

View More

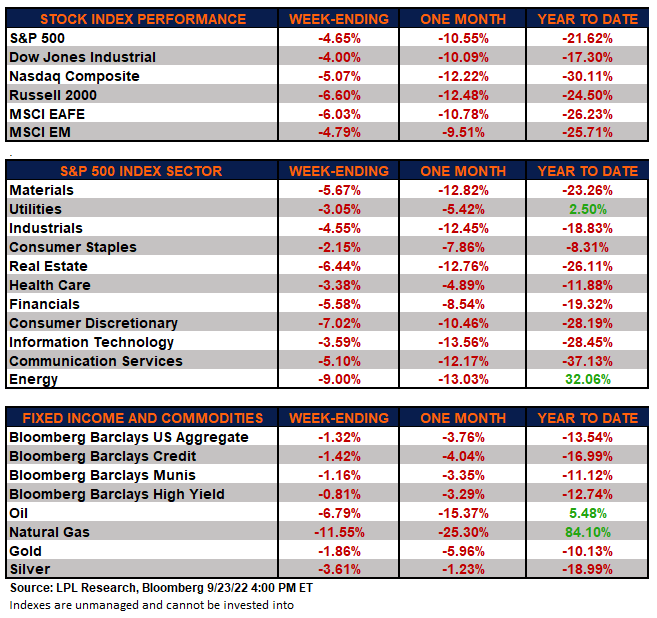

Markets Selloff For Fourth out of Five Straight Weeks

September 30, 2022

U.S. and International EquitiesMarkets Finish LowerMarkets worldwide were down sharply this week with the S&P 500 Index finishing over 3% lower for the fourth week in the past five. Investors are worried that given Q3 earnings warnings and other signs of a slowing economy, the Federal Reserve (Fed) will steer the economy into a hard landing as they attempt to curb present price pressures.Moreover, many market participants believe that Q3 estimates, which have been slashed over 6% from the en

View More

Important Retirement Age Milestones (Age 50 - 72)

August 2, 2022.png)

Retirement can be difficult to navigate—planning when to retire and making sure you’ll have enough money are just the tip of the iceberg. Meet key deadlines and avoid penalties to maximize your retirement benefits. Here are important milestones to add to your plan: Age 50—Employees, age 50 and older, can defer paying income taxes with catch-up contributions to their 401(k), up to $27,000. That’s $6,500 more than younger employees. IRA-holders can defer taxes on

View More

How Do I Correct Excess Roth IRA Contributions?

July 26, 2022

Contributing to a Roth IRA is a great way to receive tax benefits for retirement savers. If you already do or are planning to take advantage of this tax savings vehicle, it is important to familiarize yourself with the rules that govern these accounts. The IRS has put in place strict limits regarding the amount that individuals can contribute to their Roth IRAs, as well as income limits for determining who qualifies. If you are a single tax filer, you must have Modified Adjusted Growth Inco

View More

Investing for Impact (ESG, SRI, Impact Investing)

July 19, 2022

Many investors are looking toMany investors are looking to build a portfolio that reflects their socially responsible values while giving them the potential for solid returns. That’s where SRI Investing, Impact Investing, and ESG Investing may play a role.In the past, some investors regarded these investment strategies as too restrictive. But over time, improved evaluative data and competitive returns made these strategies more mainstream. Even though SRI, ESG investing, and Impact Investi

View More

Retirement Roadblocks—Choosing a Financial Advisor

July 14, 2022Don’t walk the investing path alone. Few financial concepts get more airtime than the admonishment to start early and stick with your retirement plan. We all know it’s important, but the task can seem downright daunting! There’s good news, though. “Saving for retirement is a marathon, not a sprint,” says Chad Waddoups, vice president of investment and insurance services at Mountain America Credit Union, “and you don’t have to hold a degree in

View More

Mega Backdoor Roth Explained!

July 14, 2022Everyone thinks about saving for retirement, and not many people want to work forever. However, have you thought about the best way to save for the future? If you are setting aside the yearly max in your 401(k) and channeling extra savings to your brokerage, you might be missing out on powerful tax-advantaged saving opportunities. In this article, we will show you how we help clients maximize savings, minimize taxes and secure their future using the Mega Backdoor Roth IRA.

View More

Making a Charitable Contribution

July 14, 2022

Why sell shares when you can gift them? If you have appreciated stocks in your portfolio, you might want to consider donating those shares to charity rather than selling them.Donating appreciated securities to a tax-qualified charity may allow you to manage your taxes and benefit the charity. If you have held the stock for more than a year, you may be able to deduct from your taxes the fair market value of the stock in the year that you donate. If the charity is tax-exempt, it may not face capit

View More

Tips for Students Planning to Work During the Summer

June 22, 2022

As the summer break from school approaches, many students are looking for part-time summer employment. Both parents and students should be aware of the tax issues that need to be considered when working a summer job. Here is a rundown of some of the more common issues.

View More

June 15 Is an Important Filing Deadline

June 22, 2022

Article Highlights: Americans Living and Working AbroadExtension RequestsReport of Foreign Bank and Financial Accounts (FBAR)Statement of Foreign Financial AssetsEstimated Tax PaymentsEstimated Safe Harbors June 15 is the due date both for Americans living and working outside the U.S. to file their 2021 federal income tax returns and for the second estimated tax payment for 2022. Here are some important details for both. Americans Living and Working Abroad - U.S. citizens and res

View More

What Every Employee Needs to Know About 401(k) Savings

June 14, 2022

More and more employers are offering 401(k) plans as an employee benefit, and if you have the option and are not currently taking advantage of it, it may be time to rethink your savings strategy.

View More

When Can You Dump Old Tax Records?

June 14, 2022

With certain exceptions, the statute for assessing additional tax is 3 years from the return due date or the date the return was filed, whichever is later.

View More

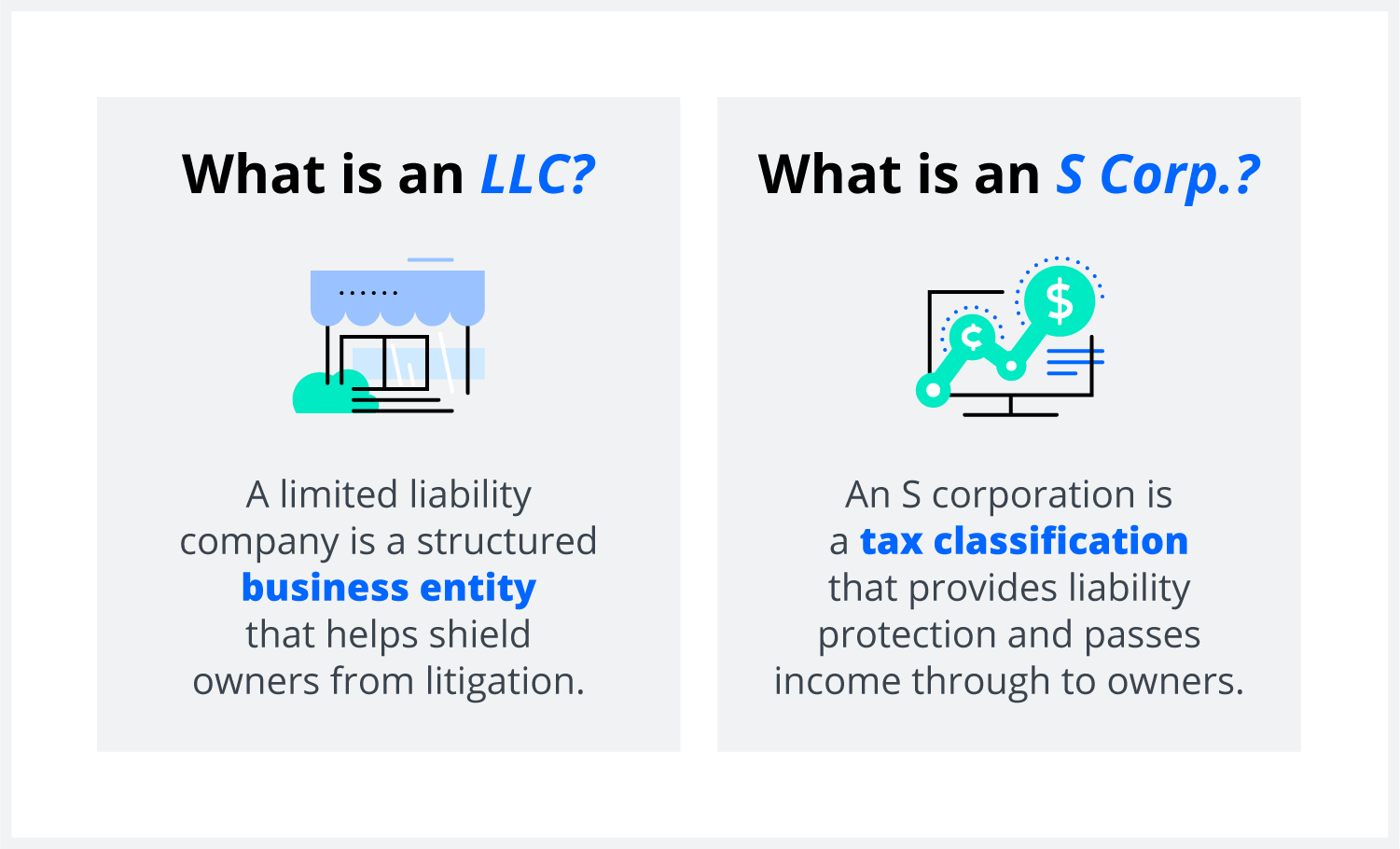

Corporate and LLC Structure Can Protect Sole Proprietors’ Assets

June 14, 2022

Where are plenty of advantages to being your own boss, but that doesn’t mean that every decision is easy or straightforward. One of the first things you’ll have to decide is the type of business structure that is best for your situation. While selecting “sole proprietor” may seem like the path of least resistance, if you have personal assets at risk for your business’ debts and liabilities, it may make more sense to go with the more complicated route of electing to

View More

Important Times to Seek Assistance for Tax Savings

June 14, 2022

Article Highlights: When to seek professional assistanceExamples of times where tax saving moves can be made Waiting for your regular appointment to discuss current tax-related issues can create problems or cause you to miss out on beneficial options that need to be timely exercised before year-end. Generally, you should call this office any time you have a substantial change in taxable income or deductions. By doing so, we can advise you about how to optimize your tax liability, avoid o

View More

With a Possible Recession Looming, You May Want to Review Your Cash Flow Process

June 14, 2022

If you’re a business owner who has been through a recession before, you know that smart cash flow management is absolutely crucial. If you’re a new entrepreneur who hasn’t been through an economic downturn, you may be less familiar with how quickly your finances can be affected. To protect yourself and keep your business operating, here are the things you need to know about adjusting your cash flow process to match the economic environment. Evaluate Your Expenses &nb

View More

Forgot Something on Your Tax Return? It’s Not Too Late to Amend the Return

June 14, 2022Helping Small Businesses Succeed Strengthens Local Economies

May 24, 2022Small businesses play a big role in the U.S. economy, and springtime is a great time to recognize their importance. Whether you’re buying Mother’s Day gifts, garden supplies, athletic apparel, books, electronics, lawn and patio items—or something else—consider buying them at a local small business instead of a big box store. Not only will you help the small business, you’ll help your local economy.U.S. Small Business Administration (SBA) District Director Beth Goldb

View More

May is Military Appreciation Month

May 24, 2022When General Douglas MacArthur accepted the Sylvanus Thayer Award in May 1962 at West Point, his speech to cadets included three words that still resonate with U.S. military personnel everywhere: “Duty. Honor. Country,” General MacArthur said. “Those three hallowed words reverently dictate what you ought to be, what you can be, what you will be.”The lifelong commitment behind those three words is one of the many reasons we celebrate Military Appreciation Month. Congress o

View More

Intimidated by Accounting? Five Simple Steps Are All You Need

March 17, 2022.png)

Avoid mixing business expenses with personal expenses. Log expenses and payments every single day. If you can’t handle your accounting tasks, get help.

View More

Another Inflation Surprise Shifts Fed Expectations

March 4, 2022

Should we be surprised at inflation surprises at this point? The Consumer Price Index (CPI), the most well known measure of inflation, climbed 7.5% over the last year through January, its highest reading since 1982, according to data released this morning by the Labor Department.

View More

What Could The End Of The Omicron Surge Mean For Inflation?

March 4, 2022

As COVID-19 cases in the United States linked to the Omicron variant have fallen dramatically during the past month we look once more to high-frequency data for signals on how quickly the economy is reopening and what this could mean for the inflation outlook.

View More

How Many Seats Could The Democrats Lose In November?

March 4, 2022

One of the most popular questions we've received lately is what could happen in the upcoming midterm election? Although we are a long way away from Election Day, it is important to note that a new president has historically lost about 30 House seats in the midterm election.

View More

Gold Breaks Out!

March 4, 2022Both stocks and bonds have faltered to start the year, with the S&P 500 down approximately 8% year to date and the Bloomberg Aggregate Bond Index down about 4%. However, this tough environment for traditional asset classes has given gold, an asset many investors have forgotten about over the past decade, some time to shine.

View More

Munis Have Held Up (Relatively) Well in Periods of Rising Rates

March 4, 2022

The municipal market was a relative bright spot within the fixed income markets last year despite higher U.S. Treasury yields. Strong investor demand and fewer investment opportunities (due to less debt issuance) provided a tailwind to muni returns.

View More

Tax Benefits When Saving for College Education

March 3, 2022.png)

A common question among parents is, “How might I save for a child’s post-secondary education in a tax beneficial way?” The answer depends on how much the education is expected to cost and how much time is left until the child heads off to college or a university or enters an apprenticeship program.

View More

Avoiding IRS Underpayment Penalties

February 17, 2022.png)

Congress considers our tax system a “pay-as-you-earn” system. To facilitate that concept, the government has provided several means of assisting taxpayers in meeting the “pay-as-you-earn” requirement.

View More

Will the Year of the Tiger Make the Bulls Smile?

February 10, 2022“Bulls make money, bears make money, and pigs get slaughtered.” Old Wall Street saying. The Chinese New Year (often called the Lunar New Year) kicked off on Tuesday, February 1, and with it will begin the Year of the Tiger. Although we would never suggest investing based on the zodiac signs (and there is no talk of Tigers in the quote above) —it is important to note that the Year of the Tiger has historically been quite strong for equities. Again, we’d never suggest to invest on zodiac signs, b

View More

What Would 5 Rate Hikes Mean for Stocks?

February 10, 2022

The Federal Reserve (Fed) has made a decidedly hawkish pivot, with fed funds futures now expecting five rate hikes in 2022. For our full breakdown of the latest Fed meeting, please read our January 27 blog, Federal Reserve Meeting Recap: March is Officially Live. However, today we want to take a look at other years that had a lot of rate hikes. “Five rates hikes in 2022 sounds pretty scary to a lot of investors who haven’t lived through a period of hiking,” explained LPL Financial Chief Market

View More

January Market Insights – Markets Lose Ground to Begin 2022

February 10, 2022Equities lost ground in January after a strong 2021. Increased COVID-19 cases, inflation concerns, and the Federal Reserve’s (Fed) recent hawkish sentiment were major themes in investor’s minds. Moreover, disappointing outlooks from some widely followed tech companies amid relatively high growth equity valuations put downward pressure on stock prices. Developed international market (MSCI EAFE) and emerging market (MSCI EM) stocks also pulled back in January. High COVID-19 variant cases worldwid

View More

Global Interest Rates Are on the Rise

February 10, 2022

With the recent hawkish pivot by the Federal Reserve (Fed) indicating a now quicker removal of monetary accommodation, U.S. Treasury yields have moved higher to start the year. Over the past few months, the Fed has indicated it will end its bond buying program in March, start its interest rate hiking campaign (likely starting in March with five hikes expected currently), and potentially reduce its nearly $9 trillion balance sheet (likely starting in July). The sudden shift in expectations has ca

View More

Stocks Stage an Extraordinary Comeback, But What Comes Next?

February 10, 2022On Friday, January 21, the S&P 500 Index closed below its 200-day moving average for the first time since June 2020 and by mid-day on Monday was 10% below its all-time highs, one of the fastest 10% declines from the start of a year on record. “Big market swings tend to signal more market volatility ahead,” explained LPL Financial Asset Allocation Strategist Barry Gilbert. “But after these kinds of pullbacks there’s an increased likelihood of above-average returns over the next three and six mont

View More

Corporate Credit Markets are Healthy but Remain Expensive

February 10, 2022

Like other core fixed income sectors, investment grade corporate credit has had a tough start to the year. After losing 1.0% last year, investment grade corporate debt is off another 2.4% (through January 14) in 2022. However, the paper losses this year (and last year frankly) are not due to declining credit fundamentals or deteriorating credit conditions. To take advantage of low interest rates, shore up balance sheets and extend maturities, corporate CFOs have issued record amounts of debt ove

View More

Record High for the Consumer Staples Sector

February 10, 2022

The S&P 500 closed at a record high in December, technology, which as we noted last month, has been showing consistent relative strength since May and was boosted by a more than 10% gain from Apple for the week. However, the other sector to do so may surprise people: consumer staples.

View More

Five Important Charts To See Right Now

February 10, 2022

As we head into the end of 2021, here are five charts that caught our attention. First up, last week was one of the best weeks of the year for stocks, and that could be a good sign. “It turns out that big weeks like last week usually have the bulls smiling,” explained LPL Financial Chief Market Strategist Ryan Detrick. “23 out of the past 25 times the S&P 500 Index gained at least 3.8% in a week, it was higher three months later.”

View More

Are You a Candidate for Bunching?

February 3, 2022.png)

The changes in the 2017 Tax Cuts and Jobs Act (TCJA) included nearly doubling the standard deduction and placing limitations on or suspending certain itemized deductions, effective for tax years 2018 through 2025.

View More

Watch Out for Tax Penalties

January 20, 2022.png)

Most taxpayers don’t intentionally incur tax penalties, but many who are penalized are simply unaware of the penalties or the possible damage they can do to their wallets. As tax season approaches, let’s look at some of the more commonly encountered penalties and how they may be avoided.

View More

The Fed Plans to Keep Interest Rates Low Until Inflation Catches Up

January 18, 2022.png)

Federal Reserve Officials are planning to keep loan interest rates historically low and near zero through at least 2023. This is a tactic to hopefully help the rest of the economy back to full strength after the recession caused by the pandemic brought things to slump. All of this was communicated in their September policy statement and economic projections released in the first week of September.

View More

Today's Retirement Plans Could Use a Shift from the 4 Percent Rule

January 18, 2022.png)

Now that we are over twenty years past when the Four Percent Rule was written, financial experts have recognized that this simple go-to rule needs some tweaking to continue to help retirees live comfortably in the new decade and decades to come.

View More

Options for Passing Your Family Home Down to Your Children

January 18, 2022

When you get down to the logistics of actually passing on the property to your children, it needs to be looked at as a business transaction, putting warm feelings aside. There are several legal factors that go into passing your home on to your children, including tax requirements.

View More

Investing in Your Health Now Can Help Your Wealth Later

January 18, 2022

It is not only the medical world that sees the ties between health and wealth. Many financial planners see the relations as well. A better quality of health in later years can drastically reduce the financial impact of health care bills.

View More

Retirement Planning 101: A Guide to Saving for the Future

January 18, 2022.png)

Most Americans between the ages of 40 and 60 have less than $100,000 set aside for their golden years. With the right knowledge and planning, you can set yourself up for a comfortable retirement. Here are some good things to know when it comes to retirement planning.

View More

Clarity Tax Management PS and Multop Merges with Hilsinger & Company

January 18, 2022.png)

We are pleased to announce that we have completed a merger with Multop Financial and Clarity Tax Management PS. We are excited about the opportunity to work with their team of professional Tax Specialists, Certified Public Accountants, Business Advisors, and Financial Planners.

View More

Federal Tax Deadlines for 2021 (Tax Filing Season Begins Feb. 12)

January 18, 2022.png)

Most adult Americans know or refer to April 15 th as tax day. We can help you to file your 2021 taxes in Kent , Vancouver, and Bellingham Washington. If you have any questions about our services or need some tax advice and/or help please contact us any time.

View More

What are Pension Plans, Do I Need One? (vs 401k)

January 18, 2022

A pension plan is a form of retirement plan offered to employees by an employer. This type of plan pays the employee a previously set income at the time the employee retires. Pension plans are less and less common as more employers have switched to offering 401(k) plans.

View More

How Biden’s Proposed American Families Plan Might Affect You

January 18, 2022

President Biden presented his proposed American Families Plan (AFP) during his Joint Session of Congress address on April 29, 2021. There are also proposed tax increases to pay for the benefits.

View More

Here’s What Happened in the World of Small Business 2021

January 18, 2022

Providing your employees with paid time off to get their vaccine will now be covered by the government, so you can encourage vaccinations if you choose without taking on the cost of offering additional PTO. If your small business is still struggling financially and you need additional funding, the EIDL expansion could help.

View More

How Employee Stock Options Are Taxed

January 18, 2022

There are two basic types of employee stock options for tax purposes, a non-statutory option and a statutory option (also referred to as the incentive stock option), and their tax treatment is significantly different.

View More

Saver’s Credit Can Help You Save for Retirement

January 18, 2022

The saver’s credit, also called the retirement savings credit, helps offset part of the first $2,000 workers voluntarily contribute to traditional or Roth individual retirement arrangements (IRAs), SIMPLE IRAs, SEPs, 401(k) plans, 403(b) plans for employees of public schools and certain tax-exempt organizations, 457 plans for state or local government employees, and the Thrift Savings Plan for federal employees. The saver’s credit is available in addition to any other tax savings that apply as a

View More

Different Types of Income Streams for Your Business

January 18, 2022

There are several different types of income streams, all of which fall into the category of either active or passive. If you are making something, selling something, or providing a service of some kind in exchange for direct payment, that is active income. While passive income also generates revenue, the payment is not as connected to the original work.

View More

Relocating? How to Do It with Taxes in Mind

January 18, 2022

Like everything else in life, relocating to another state and making it your primary residence is not as easy as just deciding to do it. It is important that you do your due diligence to make sure that you have complied with everything required of your new home.

View More

Did You Get a Letter from the IRS? Don’t Panic.

January 18, 2022

IRS notices often include errors. However, you do need to respond before the deadline specified on the notice (usually 30 days) or else face significant repercussions. The notice may even be related to suspected ID theft. The first step is to determine which type of notice you have received.

View More

The Treasury Green Book of Biden Proposed Tax Changes

January 18, 2022

The U.S. Treasury has released the Biden administration’s 2022 Fiscal Year Budget, which includes a general explanation of the administration’s 2022 revenue proposals. The publication is commonly referred to as the Green Book and outlines the Biden administration’s tax proposals.

View More

Raising Capital for Your Startup: The Basics

January 18, 2022

Creating a successful business requires a good idea combined with skill, talent, and ambition. But even if you have all of those elements, you may end up falling short if you can’t raise the capital that you need to move forward.

View More

Restaurants and Businesses Benefit from Temporary Tax Break

January 18, 2022

As part of its COVID relief efforts Congress is allowing businesses to deduct 100% of business meals during 2021 and 2022, provided the meals are provided by a restaurant. Business meals are deductible up to an amount not considered “lavish”.

View More

Understand The Tax Rules for PPP Loan Forgiveness

January 18, 2022

The general tax rule for debt forgiveness states that the amount of debt forgiven is subject to federal income tax. PPP loan forgiveness is an exception, although from an overall tax perspective it didn’t start out exactly that way.

View More

What to Know About PPP Loan Forgiveness [Updated 2021]

January 18, 2022

The rules for getting a loan forgiven are complex and continue to evolve, even though the extended deadline for applying for a PPP loan has passed. In fact, the Small Business Administration issued a new Interim Final Rule on July 28, 2021 that streamlines the forgiveness process for loans of $150 ,000 or less. And the application form for first-draw loans was updated nine times.

View More

Child Tax Credit 2021: What’s Changed?

January 18, 2022.png)

Some people are noticing a little more money in their bank account than normal this July. With some recent changes to the law governing the child tax credit, taxpayers may find themselves thinking more about taxes than just the one time a year. If you typically receive the child tax credit once a year when your return is filed, that may just be why you suddenly have more cash.

View More

8 Basic and Important Steps of the Accounting Cycle

January 10, 2022

The accounting cycle is a widely used 8-step process for completing bookkeeping tasks on a business level. It is a clear launching point for recording, analyzing, and final reporting of financial activities for a business.

View More

10 Tax-Saving Strategies to Consider Before Year-End

January 10, 2022

In the new year tax-savvy individuals need to take some time from their busy schedules to review the tax benefit steps they’ve already taken and see what else they need to do. Now is the time to ensure that you’ve taken advantage of all of the tax-saving strategies available to you.

View More

Biden Administration Backs Off on Proposed Bank Transaction Threshold

January 10, 2022.png)

On October 19, 2021, in the face of widespread opposition, the Biden administration has backed down and is now proposing raising the reporting threshold to $10,000 in annual transactions while exempting income from which federal taxes are automatically deducted, as well as federal benefits like unemployment and Social Security.

View More

Have a Forgiven Paycheck Protection Program (PPP) Loan? Understand The Tax Rules

December 28, 2021

There’s an old saying that there is no exception to the rule that every rule has an exception. Think about it. The general tax rule for debt forgiveness states that the amount of debt forgiven is subject to federal income tax. PPP loan forgiveness is an exception, although from an overall tax perspective it didn’t start out exactly that way.

View More